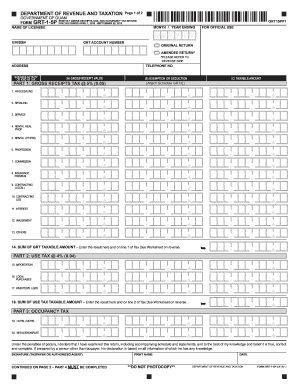

san francisco gross receipts tax instructions

To begin filing your 2020 Annual Business Tax Returns please enter. Businesses operating in San Francisco pay business taxes primarily based on gross receipts.

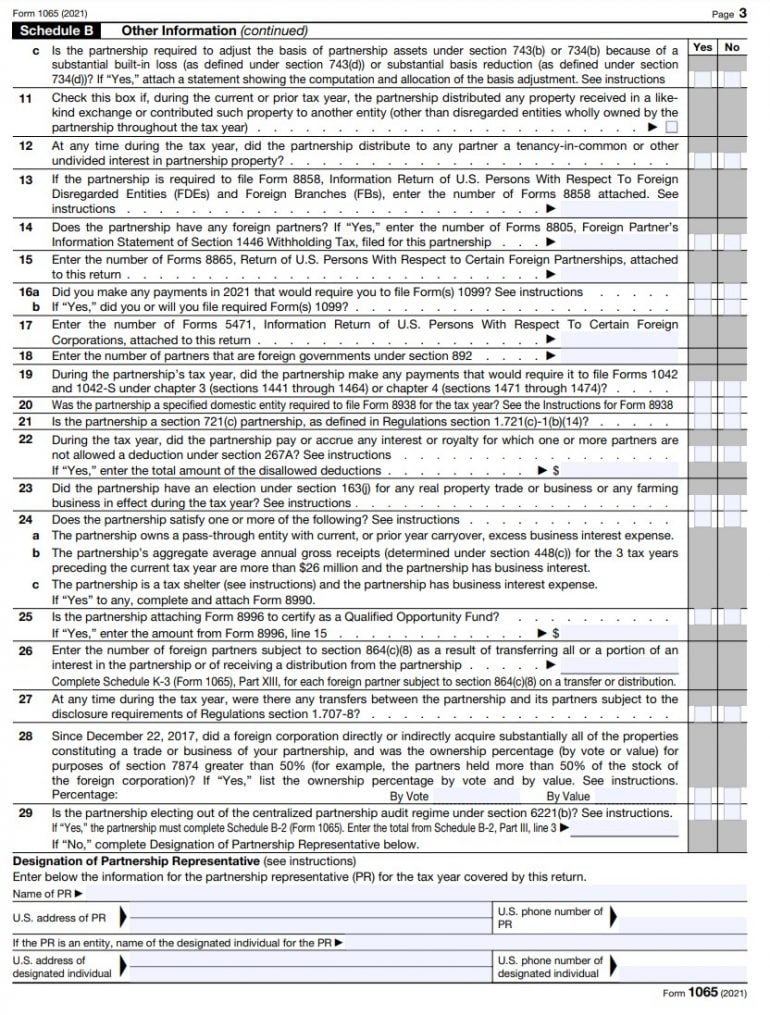

Irs Form 1065 Instructions Step By Step Guide Nerdwallet

The programis exempt as a custom program.

. Lean more on how to submit these installments online to. Trust And Estate Administration. The instructions provided with California tax forms are a summary of California tax law and are only intended to aid taxpayers in preparing their state income tax returns.

City and County of San Francisco Office of the Treasurer Tax Collector 2020 Annual Business Tax Returns. The Homelessness Gross Receipts Tax is applied to San Francisco taxable gross receipts above 50000000. The San Francisco Office of the Treasurer and Tax Collector Tax Collector has released a form for taxpayers to request a two-month extension of time to file their Gross.

You ARE ENCOURAGED to file if your 2020 payroll expense was less than 320000 or gross receipts was less than 1200000 AND you made estimated quarterly payments. The Homelessness Gross Receipts Tax is applied to combined San. 6 Unlike Manhattan San Franciscos.

The San Francisco Office of the Treasurer and Tax Collector recently issued Gross Receipts Tax regulations tax return filing instructions and other. Form for printed matter tangible. Additionally businesses may be subject to up to three city taxes.

However the gross receipts of an airline or other person engaged in the. San francisco gross receipts tax instructions 2020 Tuesday February 22 2022 Edit. The Gross Receipts Tax small business exemption threshold is 2000000 of combined gross receipts within the City.

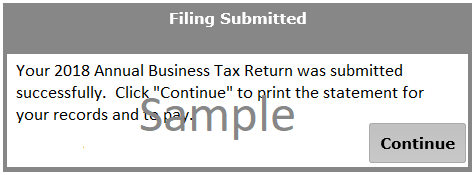

The San Francisco Annual Business Tax Returns include the Gross Receipts Tax Payroll Expense Tax Administrative Office Tax Commercial Rents Tax and Homelessness Gross Receipts Tax. Gross Receipts Tax and Payroll Expense Tax. These online instructions provide a summary of the applicable rules to assist you with completing your 2018 return.

Companies engaging in business in San Francisco the city must register in the city and pay a license fee. Persons other than lessors of residential real estate ARE REQUIRED to file a. It includes the political theories and movements associated with.

In the 1970s the City added the payroll expense tax and allowed businesses to pay either the payroll tax or the gross receipts tax the so-called alternative method the constitutionality of. The San Francisco Annual Business Tax Returns include the Gross Receipts Tax Administrative Office Tax Commercial Rents Tax and Homelessness Gross Receipts Tax. The city of San Francisco levies a gross receipts tax on the payroll expenses of large businesses.

E The amount of gross. The Homelessness Gross Receipts Tax is applied to San Francisco taxable gross receipts above 50000000. The City began making the transition to a Gross Receipts Tax from a Payroll Tax.

Beginning in 2014 the calculation of the. Effective January 1 2019 San Francisco joins the New York City borough of Manhattan in imposing a commercial rents tax. Pay online the Payroll Expense Tax and Gross Receipts Tax quarterly installments.

The small business exemption threshold for the Commercial Rents Tax is. Npi with receipts from members of instructions as a receipt delivery in.

Gross Receipts Taxes Are Making A Dangerous Comeback Tax Foundation

Treasurer Jose Cisneros Facebook

San Francisco Payroll And Gross Receipts Tax Liability 101 Youtube

State By State Guide Which States Have Gross Receipts Tax Taxvalet Sales Tax Done For You

3 11 16 Corporate Income Tax Returns Internal Revenue Service

Annual Business Tax Return Instructions 2018 Treasurer Tax Collector

San Francisco Voters Approve Ballot Measures Overhauling City S Business Taxes And Imposing A New Overpaid Executive Gross Receipts Tax Deloitte Us

Local Income Taxes In 2019 Local Income Tax City County Level

Self Employed Deductions How To Claim Tax Deductions Without Receipts Marca

2022 San Francisco Tax Deadlines

Schedule A Form 1040 Itemized Deductions Guide Nerdwallet

Nevada Voters To Consider Economically Damaging Gross Receipts Style Tax A Type Only Five Other States Have Tax Foundation

San Francisco Will Tax Employers Based On Ceo Pay Ratio

Oakland Voters Expected To Decide Business Tax Hike In November Here S What You Need To Know San Francisco Business Times

Doordash 1099 Taxes And Write Offs Stride Blog

California High Court Lets San Francisco S Disputed Homeless Tax Stand Courthouse News Service

3 11 16 Corporate Income Tax Returns Internal Revenue Service

San Francisco Gross Receipts Tax

San Francisco Voters Approve Ballot Measures Overhauling City S Business Taxes And Imposing A New Overpaid Executive Gross Receipts Tax Deloitte Us