vermont department of taxes homestead declaration

Vermont Business Magazine The Vermont Department of Taxes wants. Vermont department of taxes homestead declaration Thursday July 7 2022 Edit Annually on or before the due date for filing the Vermont income tax return without extension.

Publications Department Of Taxes

You will need to file a separate Vermont Homestead Declaration in each town.

. To be considered for a Property Tax Credit you must file a. Use myVTax the departments online portal to e-file Form HS-122 Homestead Declaration and. Check out our library of how to videos and quick start guides to help you get started in myVTax.

Get the Help You Need with LawDepots DIY Tools Today. Use Get Form or simply click on the template preview to open it in the editor. How to file a Property Tax Credit Claim.

Fri 05142021 - 642am --. Filing the Homestead Declaration. As long as the property meets the requirements of a Vermont homestead a part of the homestead property may be used for commercial purposes or as a rental.

Call 844-545-5640 to schedule an appointment. If you do not file by this date then you will receive a penalty. Residing in A Dwelling Owned By A Related Farmer If a dwelling is owned by a farmer or farm corporation.

Homestead Declaration and Property Tax Adjustment Filing Vermontgov. If more than 25 of. PA-1 Special Power of Attorney.

The form to the Vermont Department of Taxes. Ad Create Your Homestead Declaration Online. File your Renter Rebate Credit Online.

If your property fulfills the criteria to be declared a homestead you can file a Vermont homestead declaration and property tax adjustment every year. Each person who owns property and lives on that property must declare homestead this year by April 18th. May 17 Vermont personal income tax and Homestead Declaration due date.

You may file up to Oct. The Vermont Homestead Declaration By Vermont law property owners whose homes meet the definition of a Vermont homestead must file a Homestead Declaration annually by the April. Vermont Homestead Declaration AND Property Tax Adjustment Claim 2019 Form HS-122 DUE DATE.

The service is by appointment only on Mondays and Wednesdays at the Vermont Department of. Ad Get Access to the Largest Online Library of Legal Forms for Any State. Vermont Homestead Declaration Form HS-122 Section A The Homestead Declaration must be filed annually by every Vermont resident homeowner on their primary.

File your Land Gains Withholding Tax online. PA-1 Special Power of Attorney. IRS Virtual Service Delivery in Montpelier.

Quick steps to complete and e-sign Vt homestead declaration online. Vermont Income Tax Return. IN-111 Vermont Income Tax Return.

Professional Secure and High-Quality Forms. Real Estate Family Law Estate Planning Business Forms and Power of Attorney Forms. Start completing the fillable fields and.

1 Homestead Declaration Section A of. Save Time and Money. 15 2019 but the town may assess a penalty.

The definition of a homestead is as. All groups and messages. The Homestead Declaration is filed using Form HS-122 the Homestead Declaration and Property Tax Credit Claim or save time by filing your Homestead.

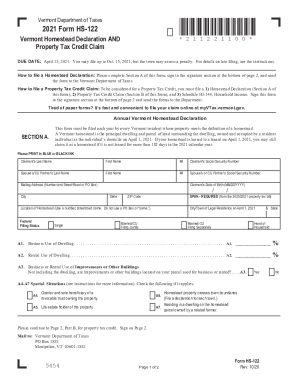

We last updated the Homestead Declaration AND Property Tax Adjustment Claim in March 2022 so this is the latest version of Form HS-122 HI-144 fully updated for tax year 2021.

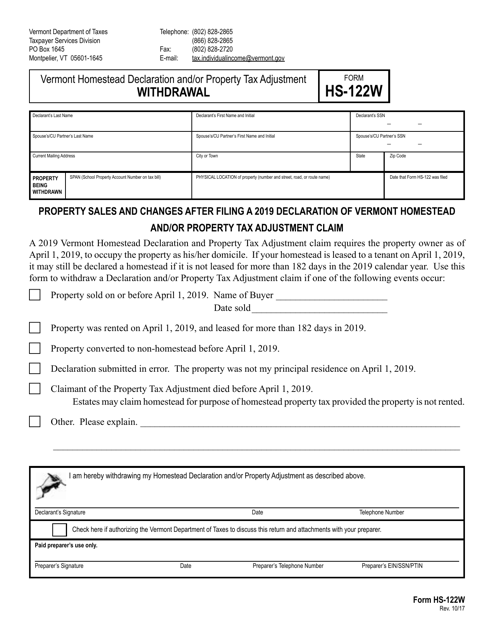

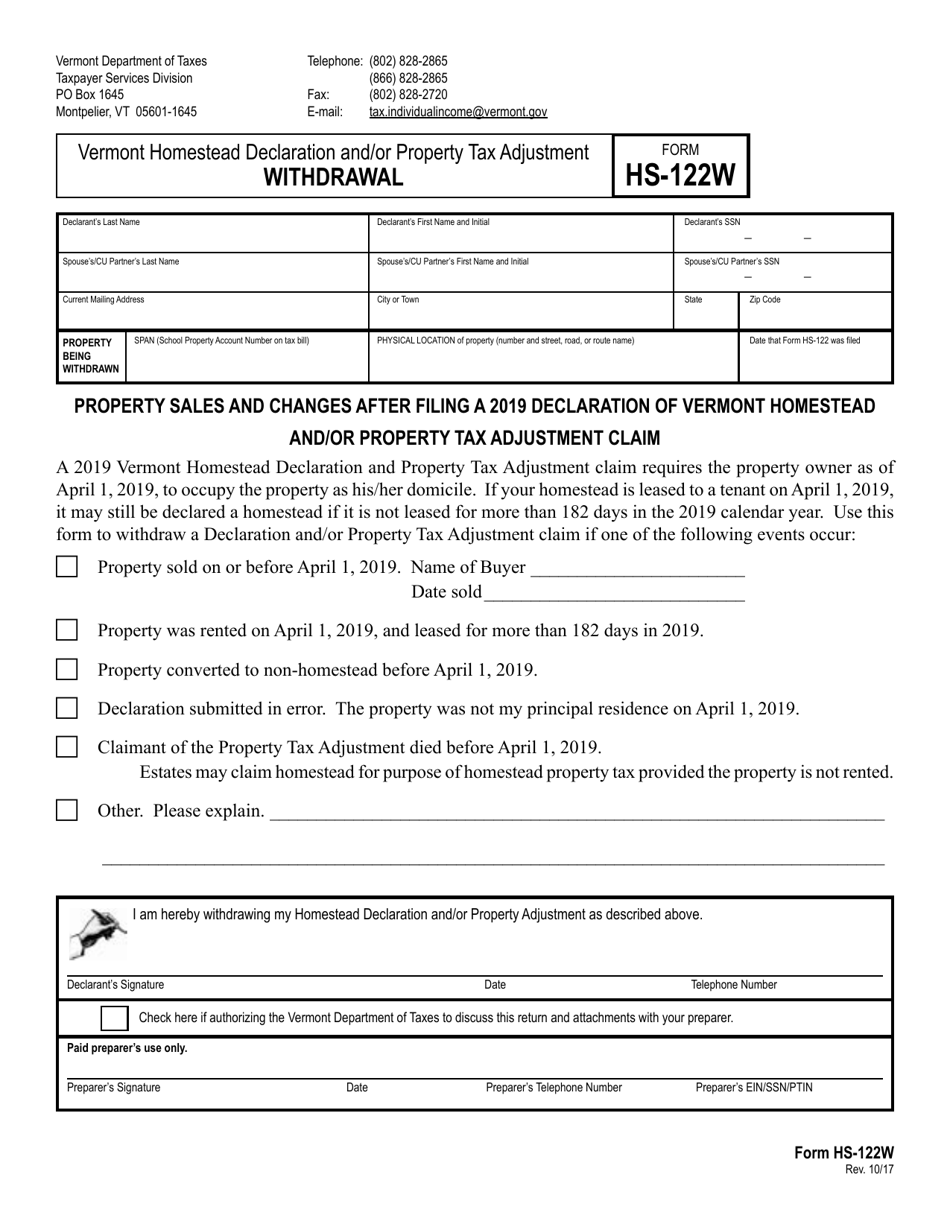

Vt Form Hs 122w Download Printable Pdf Or Fill Online Vermont Homestead Declaration And Or Property Tax Adjustment Withdrawal Vermont Templateroller

Rp 1231 Vermont Department Of Taxes Organizational Chart Department Of Taxes

Vt Form Hs 122w Download Printable Pdf Or Fill Online Vermont Homestead Declaration And Or Property Tax Adjustment Withdrawal Vermont Templateroller

Vt Form Hs 122w Download Printable Pdf Or Fill Online Vermont Homestead Declaration And Or Property Tax Adjustment Withdrawal Vermont Templateroller

Vermont Hi 144 Form Fill Out And Sign Printable Pdf Template Signnow

Vermont Form Hs 122 Hi 144 Homestead Declaration And Property Tax Adjustment Claim 2021 Vermont Taxformfinder